Latest 6 months business bank statement. Warganegara Citizen 7.

It S Income Tax Season Again But Don T Worry Here S A List Of All The Things You Can Claim As A Tax Relief For Ya 2021 Wau Post

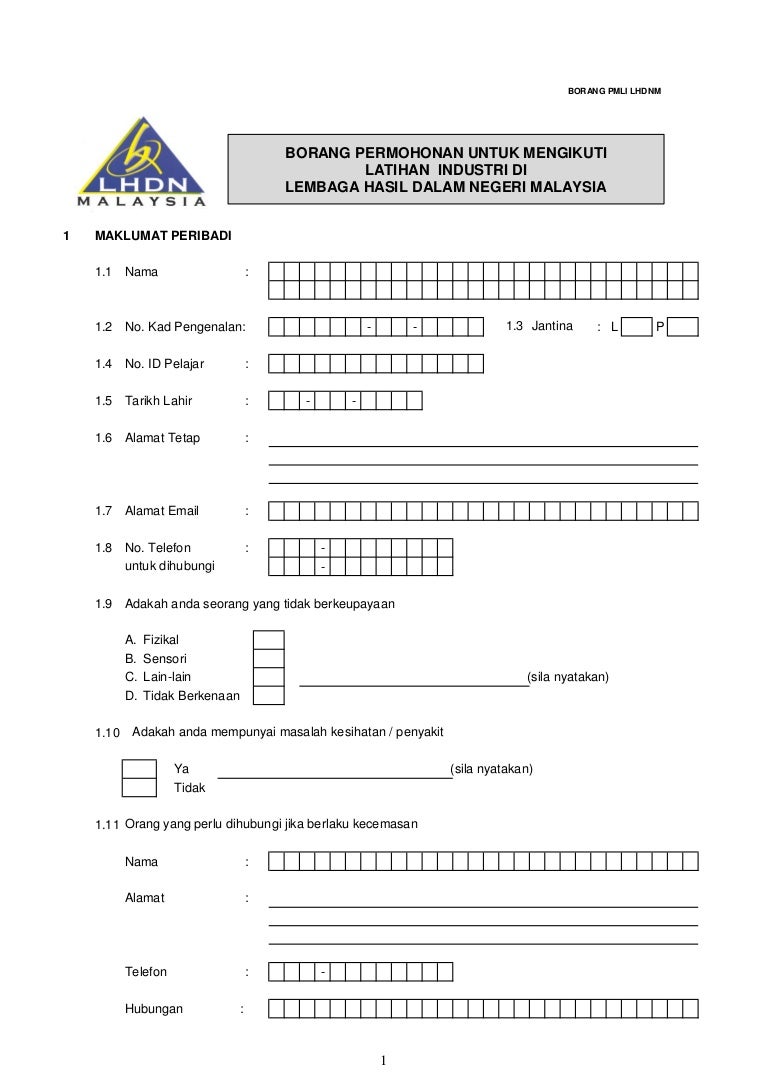

Bagi warganegara Malaysia yang mempunyai Mykad hanya No.

. Alamat surat-menyurat pekerja yang terkini Current address of employee Tarikh Dijangka Meninggalkan 12. For a Malaysian citizen who has Mykad only the MyKad No. PART H.

Valid Business Renewal License. Cukai Pendapatan Suami Isteri Husbands Wifes Income Tax No Nota. TERMA-TERMA PENGGAJIAN TERMS OF EMPLOYMENT.

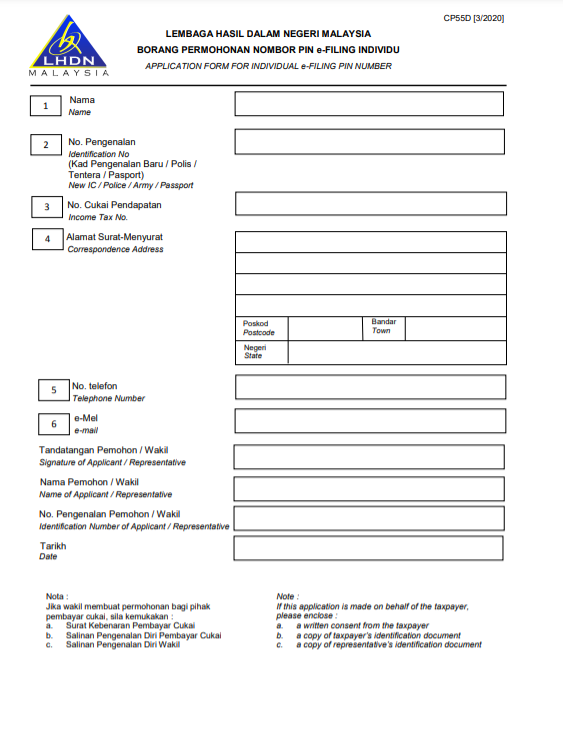

Cukai pendapatan Income tax no. MAKLUMAT EJEN CUKAI PARTICULARS OF TAX AGENT H1 Nama Name H2 Alamat firma Address of firm Poskod Postcode Bandar Town. Application for Enrollment to Practice Before the Internal Revenue Service 1020 09302020 Form 56.

Telefon Pekerja Employees Telephone No. If you have a limited liability company you must enclose income tax return 1 for the previous year salary specifications for the past three months and the companys most recent annual report and the income statement and balance sheet for the current financial year. Net change amount of increase or decrease explain in Part III.

LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22. BORANG PENDAFTARAN NOMBOR CUKAI PENDAPATAN INDIVIDU INCOME TAX NUMBER REGISTRATION FORM FOR INDIVIDUAL BAHAGIAN A. Alasan meninggalkan negara ini Reason for departure 13.

Need to be filled. W2 or W-2C Other specify If you do not have evidence of these earnings you must explain why you are unable to submit such evidence in the remarks section of Item 10. Original amount reported or as previously adjusted see instructions B.

Other form of income substantiation may be acceptable on case to case basis eg. Latest Borang B Proof of tax payment. Correction to the Instructions for Forms 1040 and 1040-SR-- 08-FEB-2021.

It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification. Instructions for Form 56 Notice Concerning Fiduciary Relationship. Tenancy Agreement or Rental Income Receipts.

Use Part III on page 2 to explain any changes. Income statement for the current financial year. 4Prepare and render to an employee a statement of remuneration Form EA EC in respect of that employee on or before the last day of February of the.

State Means-Tested Public Benefits Each state will determine which if any of its public benefits are means-tested. Federal means-tested public benefits include food stamps Medicaid Supplemental Security Income SSI Temporary Assistance for Needy Families TANF and the State Child Health Insurance Program SCHIP. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020.

Cukai Pendapatan Income Tax No. Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference. Notice Concerning Fiduciary Relationship 1219 05202020 Inst 56.

Reporting the Credits for Qualified Sick and Family Leave Wages in Gross Income-- 01-MAR-2021. Enter on lines 1 through 23 columns A through C the amounts for the return year entered above. PART A.

Tarikh Lahir Date of Birth 8. Form E will only be considered complete if CP8D is submitted within the stipulated deadline. Mykad sahaja perlu diisi.

Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. 3 BAHAGIAN H. Occupational Tax and Registration Return for Wagering 1217 12212017 Form 23.

Employers who have submitted information via e-Data Praisi need not to complete and furnish CP8D. If you do not have self-employment income that is incorrect go on to item 10 for any remarks and then complete Item 11.

Singapore Introduces Tax E Filing For All Companies Rikvin Pte Ltd

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Form Cp 58 Duty To Furnish Particulars Of Payment Made To An Agent Dealer Or Distributor Etc Malaysian Taxation 101

What Is A Schedule C Tax Form H R Block

Cp207 Remittance Slip For Form C Lembaga Hasil Dalam Negeri Fill And Sign Printable Template Online Us Legal Forms

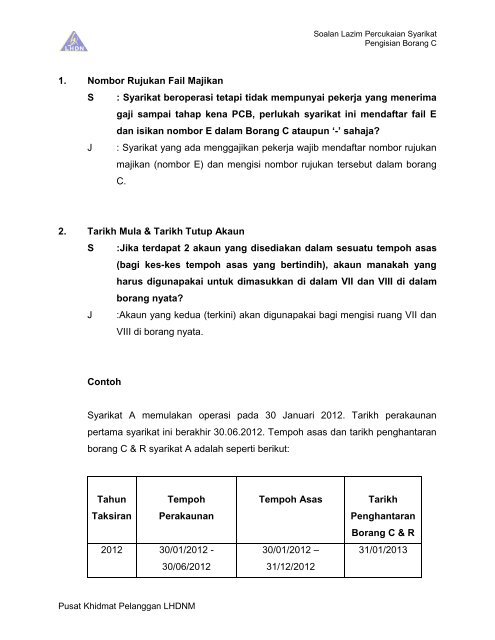

Pengisian Borang C Lembaga Hasil Dalam Negeri

Borang C Lhdn 2020 Fill Online Printable Fillable Blank Pdffiller

New Company Return Form Form C For Year Of Assessment 2019 Released By The Inland Revenue Board Of Malaysia Irbm Baker Tilly Malaysia

Income Tax Deadlines For Companies Malaysian Taxation 101